This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). WeChat: 13928404895 0717264227

Commodities of Chinese merchants have been seized and confiscated by Cambodian Customs. Recently, some customers often consult us about legal import and export commodities. Let's sort out the import and export commodity process and fiscal and tax issues with you.

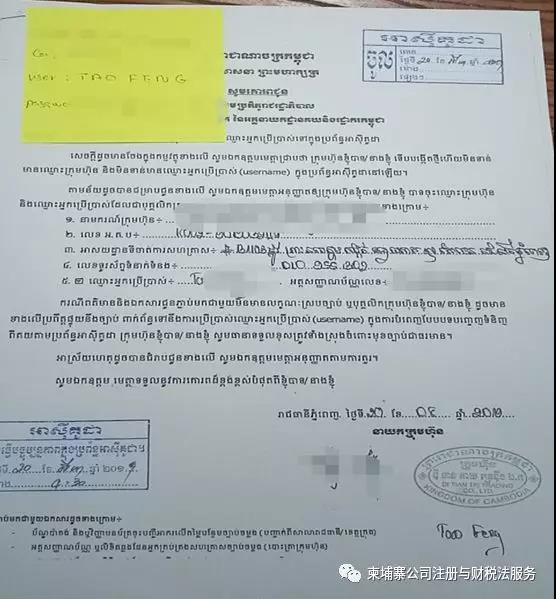

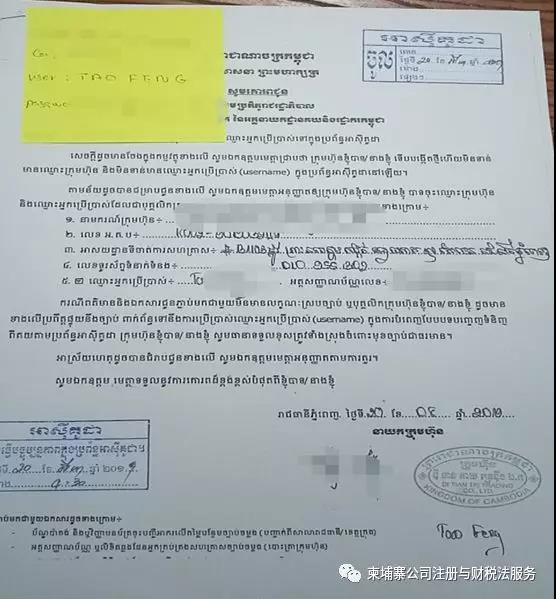

Let's take a look at the operation method that most investors currently know, that is, to entrust a third-party customs clearance company to handle it, and only provide the money, and the customs clearance company will ship the products to the designated location. The entire operation process does not need to provide company procedures, nor does it require customs import and export filing procedures, which is simple and fast. This method of operation is the so-called gray customs clearance, and there are problems: first, it is not clear whether the merchants have paid the relevant taxes in full, and second, legally speaking, these products do not belong to the merchants. Therefore, there will be a problem that the products in the above report are handled by the customs according to law. How to import and export legally? First of all, you must have the qualifications for importing and exporting goods, generally including a full set of legal company information, that is, you have obtained the relevant certificates issued by the Ministry of Commerce and the Taxation Bureau, that is, all the information of a normal company; at the same time, the company needs to have the right to import and export operations, that is, in the customs The system has completed the filing and registration, as shown in the figure below:

Second, the normal legal procedures for import and export must be completed. The first is to complete the customs declaration formalities, that is, according to the legal requirements, the goods that need to be imported and exported are declared to the customs in the company’s name and qualifications. This can be carried out by a third-party company; the second is to complete Customs clearance procedures, that is, complete the normal tax payment. Imported goods generally face two types of import value-added tax and customs duty. Value-added tax (VAT), the tax rate is generally 10%. After payment, the customs will issue a corresponding tax invoice. This part of the tax can be used as input tax. In the future, the value-added sales of goods will be deducted, which is what we usually call input tax. The other is the import tariff. This tax varies according to the imported products, and the tax rate is different. Generally, the four tax rates are 7% to 50% respectively: children's clothing, sportswear, curtains, bedspreads, toys, tea, paper, cement, The tariff rate for aluminum, glass, plastic products, and steel is 7%; the tariff rate for household appliances, other hardware products, and generators is 15% ; the tariff rate for cloth, clothing, and diamonds is 35% ; the tariff rate for cigarettes, game consoles, and diamonds is 50% .

Under the common effective tariff system of the ASEAN Free Trade Agreement, products imported from other ASEAN member countries that meet the rules of origin can enjoy lower tariff rates or zero tariffs. Of course, the special case is that imports can also be tax-free. Export-oriented qualified investment projects approved by the Cambodia Investment Commission can import production equipment, construction materials, raw materials and production input accessories tax-free, the so-called CDC tax exemption, see the previous article for details. Generally speaking, the international common practice for exporting goods is to exempt tariffs and value-added tax in order to improve the international competitiveness of domestic products.