This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). WeChat: 13928404895, 0717264227

Lao Li still couldn't hold back, and cursed: "A fine of 1,200, a VAT tax of more than 10,000, and an income tax of more than 20,000 at the end of March next year, how much can I make? What do you want you to do for food?"

Lao Li still couldn't hold back, and cursed: "A fine of 1,200, a VAT tax of more than 10,000, and an income tax of more than 20,000 at the end of March next year, how much can I make? What do you want you to do for food?"

Xiao Zhang's aggrieved tears rolled in his eyes, and he didn't know what to say. Follow the boss to Xigang alone, eat soil diarrhea and watch headshots. She also asked a lot of people about this, including the Tax Bureau twice, but she didn't understand it. But because of this, the boss did have to spend nearly 300,000 yuan, and the boss did lose money. The story may happen again. As a boss who starts a business in Cambodia, what taxes do you have to pay in Cambodia?

Lease tax: withholding tax, 10% of the rent amount of the leased office factory is provided when the company is registered, payable from the lease start date. First of all, it is a kind of withholding tax, because the landlord has income, but the lessee has to withhold and pay it. The lessor is obliged to pay the tax regardless of whether the company is registered or not, and the lessee is obliged to withhold and pay it. And pay from the day of renting. If the company has not paid before after registration, the tax of the previous month must be paid in full at one time, and the tax will be paid on time every month thereafter. Therefore, when signing the lease contract, it is necessary to clarify who pays the lease tax, that is, whether the rent is pre-tax or after-tax.

Value-added tax: VAT, 10% of the turnover, put it in place, 10% of the invoicing turnover, minus the difference after the input value-added tax. I bought a batch of goods worth 1 million, 10% of the value-added tax, paid 1.1 million, the seller issued us a value-added tax invoice, sold this batch of 1.5 million, 10% of the value-added tax of 150,000, the total collection 1.65 million, and issued a special value-added tax invoice to the buyer. In this matter, the company should pay VAT 150,000-100,000 = 50,000 yuan. The main feature of VAT is that tax is calculated at 10% when invoices are issued, and how much tax is paid is critical to the input.

Minimum Tax: Minimum Tax, a characteristic tax of Cambodia. Prepaid monthly at 1% of turnover. That is, whether the company is profitable or not in the current month, it must pay the enterprise income tax at 1% of the turnover in advance. Yes, it must be paid at the loss, and if the profit is large, it will also be paid at 1% in advance.

Corporate income tax: Tax on Profit, 20% of the corporate profit. The income tax will be settled and paid at the end of March of the following year. Cambodia is called the end of the year closed account. After deducting the cost and expenses recognized by the tax law, the company's income is calculated at 20%, and minus the minimum tax paid before, is the annual corporate income tax that should be paid. The key point of corporate income tax is the cost and expenses recognized by the tax law. Which ones are recognized by the tax law? Value-added tax invoices, customs invoices, reasonable wages, utility invoices issued by government departments, and related depreciation and amortization in accordance with laws and regulations. Does the receipt count? No, if you want to do it, the company has to pay a 10% tax.

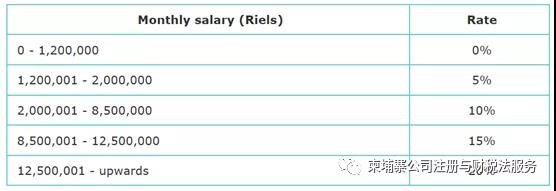

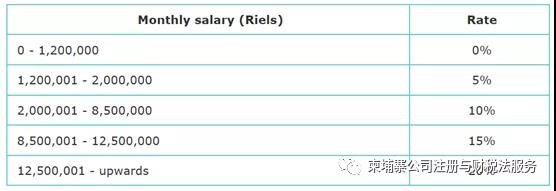

Personal income tax: Tax on Salary, which is exactly the same as China's personal income tax philosophy, implements an excessive progressive tax rate. What is excess progressive? Ask Baidu. The threshold is 300 US dollars, and the tax rate is 5%-20%. The tax rate table is as follows:

In addition to the high consumption in Cambodia, there is a high tax penalty, which is 500 US dollars per month for not filing taxes on time. Then calculate the late fee and interest based on the tax payable. If tax planning is not done well, another 20% corporate income tax will be paid at the end of the year. Lao Li is going to curse.