This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). Customer Service WeChat: exe5555, 0974589151

After investing and establishing a business in Cambodia, how should the corresponding financial and taxation be handled? What information should be kept after the legal and compliance processing?

Let’s sort out the Cambodian tax filing process. The company first provides the accountant with the relevant invoices, bank records, etc. of the previous month, and the accountant makes accounting records based on this to form accounting vouchers, etc., and then fills in the Cambodian tax filing information and calculates the current month’s payment. After paying the tax, the company is required to sign and seal the tax return and collect the relevant tax on its behalf, and then take the tax to the bank (to the bank) to pay the tax, and finally submit the tax return and tax payment form to the tax supervisor Departments and taxation authorities will return the tax declaration information after the verification is correct, which is the tax return receipt. Before the end of March of the following year, the account will be closed at the end of the year based on the accounting records and tax return receipt.

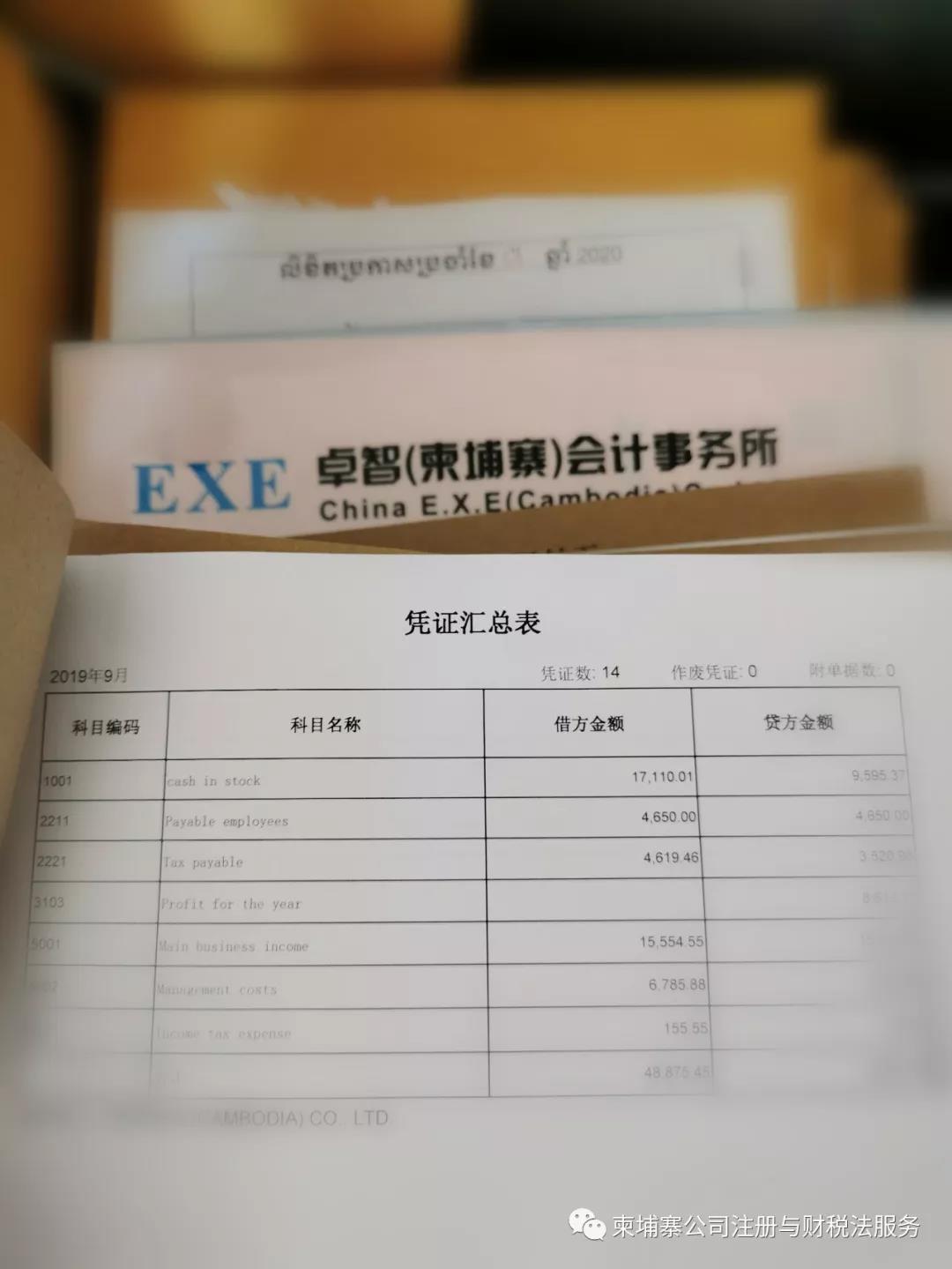

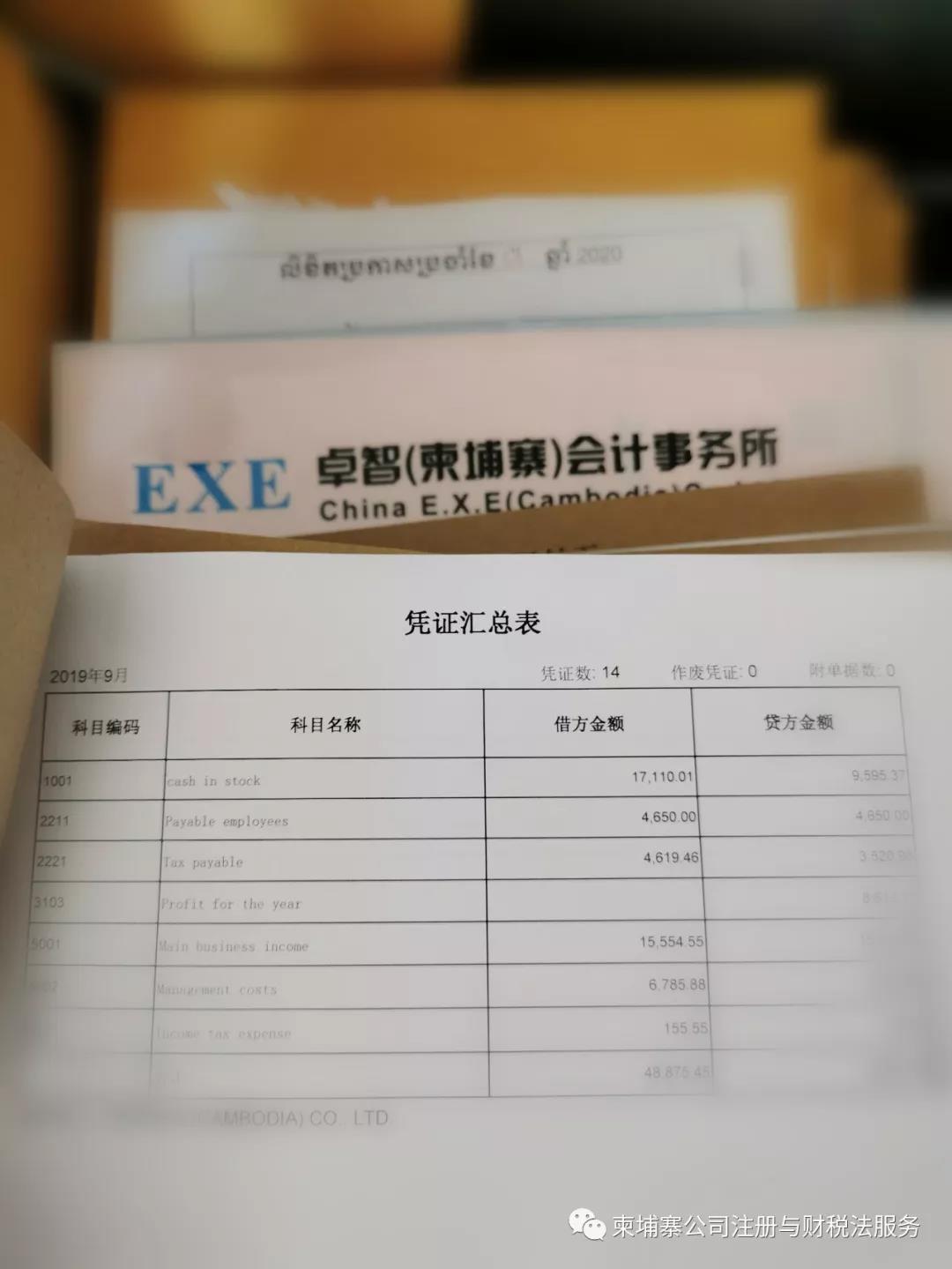

Accounting documents (accounting records)

Cambodian law stipulates that companies must establish accounting records in accordance with the law to truthfully reflect the company's operating conditions, accurately calculate and record corporate profits and tax payables, and truthfully provide accounting attachments (evidence such as invoice flow) and bind them into accounting vouchers. According to the law, it is possible to record accounting business in English, use non-riel (USD) as the standard currency for bookkeeping, and have financial statements, namely balance sheets, income statements, etc. Accounting vouchers are direct evidence of the accuracy of corporate tax calculations. The format of Cambodian accounting voucher is as follows:

Tax payment slip

Since taxes are generally collected by the accountant, and some landlords also need to see the relevant lease tax payment form in time to ensure that the tax has been actually paid to the treasury, the enterprise should promptly request the tax payment form from the accountant. The payment slip is generally available on the same day or the next day, which mainly depends on the work arrangement of the accountant (on the spot by the bank). The tax payment slip is direct evidence of the tax paid by the enterprise. The Cambodian tax payment form is as follows:

Tax return receipt

The tax return receipt includes the tax payment slip and the tax return information, and the tax authority will affix the official seal on it after confirming that it is correct. So when can I get the tax return receipt? At present, all districts in Phnom Penh generally get tax return receipts on the day of tax filing. Companies that file tax returns at the Phnom Penh Tax Administration (ie large companies) generally get tax return receipts in the next month. Since Xigang has a large tax filing company and fewer staff in the tax bureau, it is generally required It takes about three months to get the tax return receipt. The tax return receipt is the direct evidence that the enterprise has completed the tax return in accordance with the procedures. The form of the tax return receipt is as follows:

Closing accounts at the end of the year

We have talked about this in the previous articles, and you can check for related articles. Closing the account at the end of the year is like your wife checking your net income of the previous year, all bank cards, all documents, home time, phone bills, air tickets, any one of them is not right, you may be found out about raising a girlfriend. ! There are a lot of people recruited, so pay attention to it!