This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). Customer Service WeChat: exe5555, 0974589151

Chinese investors who operate companies in Cambodia often ask whether Cambodia has invoices? If you ask someone else, they will give you a hand-opened Invoice. At that time, you didn't dare to ask, is this an invoice? Does Cambodia have the same official invoice as China?

The handwritten invoices you get are almost useless for accounting and tax reporting. They cannot deduct value-added tax and cannot directly deduct costs (you need to pay the withholding tax to deduct the costs). What does the official Cambodia invoice look like? Where do I need to buy this kind of invoice?

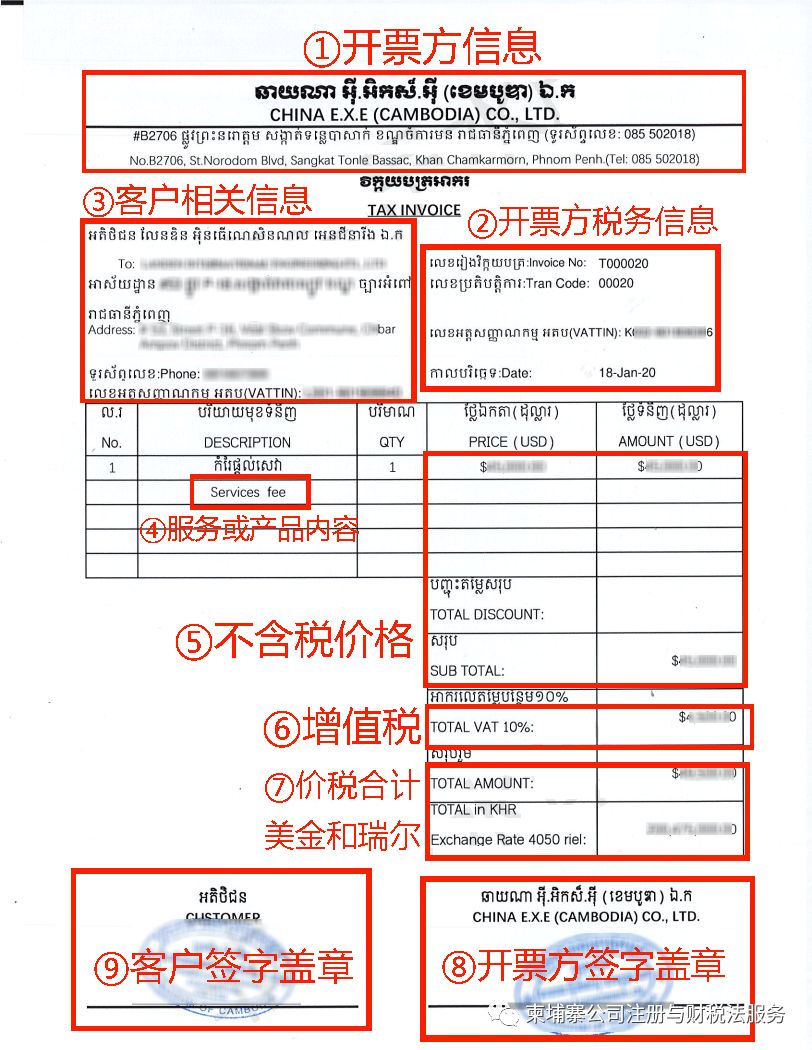

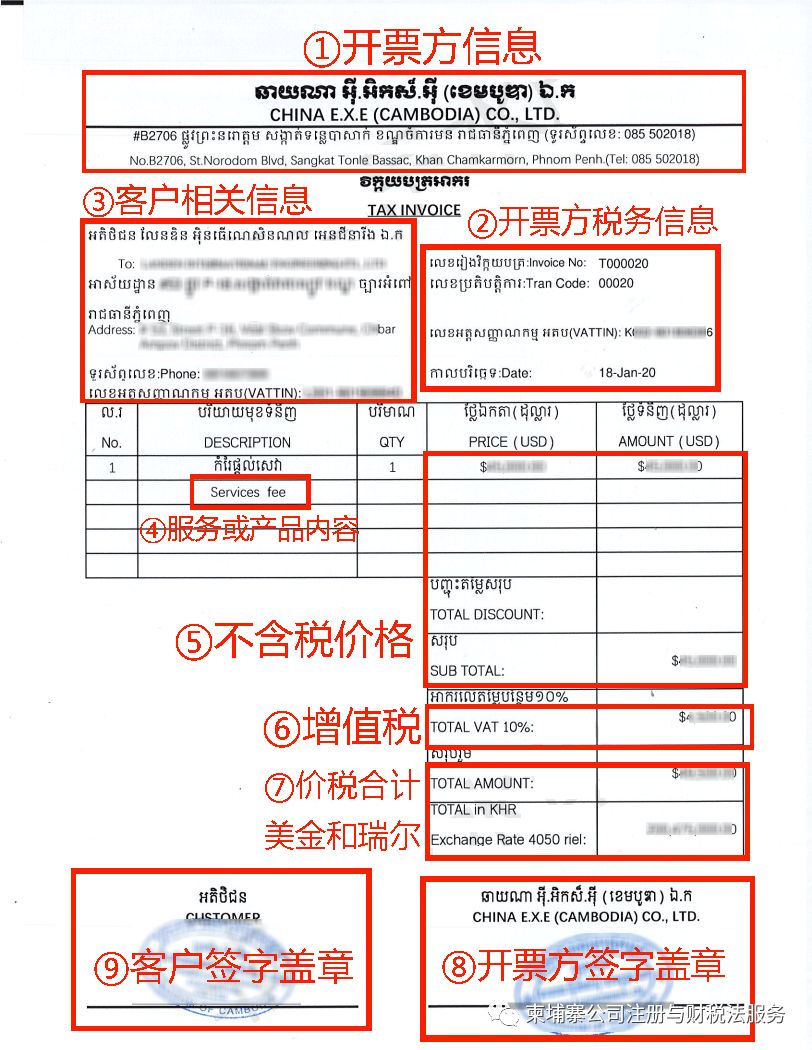

The Cambodian invoice is an invoice. The government only stipulates the main content contained in the invoice. After the company designs and prints it, both parties sign and seal it to take effect. It's as simple as that. What content must be included in the invoice? Let me give you a sample map of the Cambodian invoice:

1. Information of the issuing party: It mainly includes the name of the issuing party’s company, registered address, contact phone number, and some of the company’s LOGO.

2. Information of the issuing party: It mainly includes the invoice number (to be issued by serial number), the tax number of the issuing party, and the date of issuing the invoice.

3. Customer information: company name, registered address, contact number, tax number.

4. Service product content: what service is provided or what product is sold.

5. Price without tax: unit price and total price without tax.

6. Value-added tax: the amount of value-added tax that should be paid.

7. Total price and tax: the total of product and service prices and value-added tax, that is, the total amount payable.

8. Seal of the issuing party: sign and seal to confirm the validity.

9. Customer seal: sign and seal to confirm the validity.

I hope I can help you. If you need an electronic version of the invoice, you can contact us to get it for free.