This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). Customer Service WeChat: exe5555, 0974589151

In 2020, the Royal Government of Cambodia updated the relevant tax laws, and they have come into effect one after another. We have recently learned about the impact they may have on our customers and are helping them to better apply related changes. Let's discuss relevant updates in detail with you.

Dividend income tax

When a Cambodian company distributes dividends or makes equity transfers, it corresponds to the undistributed profits formed in the previous year and the profits generated in the current year. When it is distributed to shareholders or equity transfers, it must pay dividend income tax at 20%. This part of the tax cost can be included. Deduct the company's profits for the company's costs and expenses. It is particularly emphasized that when the Cambodian branch remits taxable income back to its overseas company, it will be regarded as non-resident taxpayer income from business activities carried out through a permanent establishment in accordance with Article 10 of the Tax Law, and shall pay a 14% prepayment taxi. This is also the main reason why it is difficult to change the company's equity, especially the equity of a gambling company.

The updated tax law stipulates that starting from January 1, 2020, QIP entities (ie, CDC-certified enterprises) during the corporate income tax exemption period will be exempted from dividend income tax for shareholders for dividend distribution.

Zhuo Zhi commented: The updated tax law is particularly beneficial to CDC companies. It is recommended that CDC companies carry out relevant profit distribution during the policy period. At the same time, the update will cause more companies to apply for CDC certification. This update has no impact on non-CDC companies.

Personal Income Tax

The Royal Government of Cambodia has also updated the progressive tax rates for resident taxpayers' personal income tax and employee income tax. The specific tax rates are as follows. Resident taxpayers refer to natural persons who have lived in Cambodia for 183 days a year, and employees refer to employees, that is, income tax on wages and salaries.

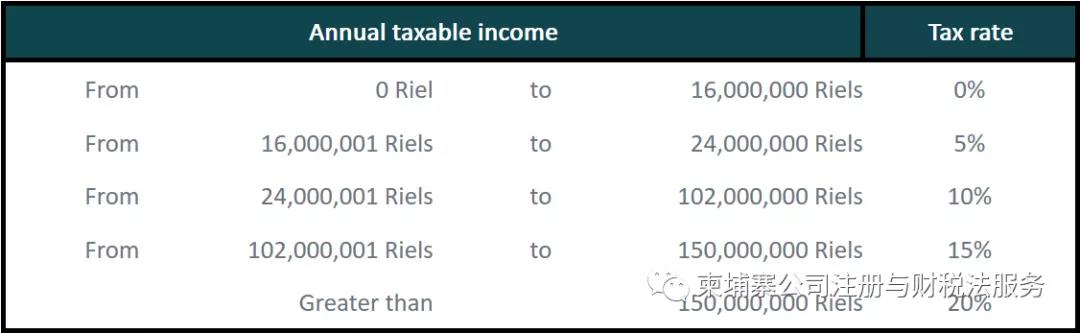

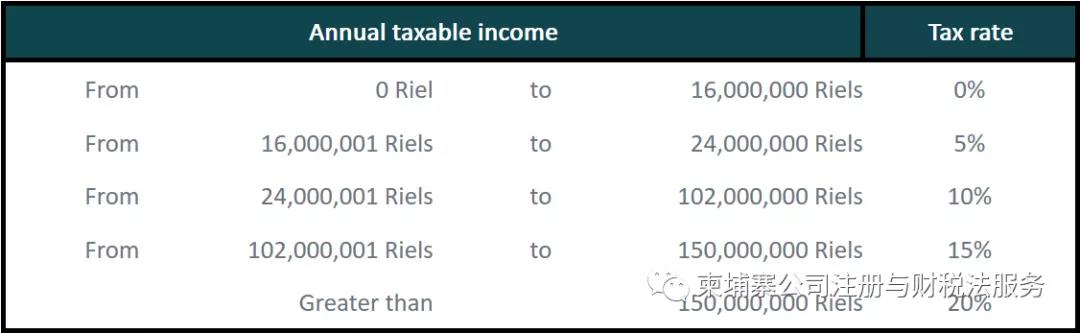

Progressive tax rate for non-wage income of resident taxpayers:

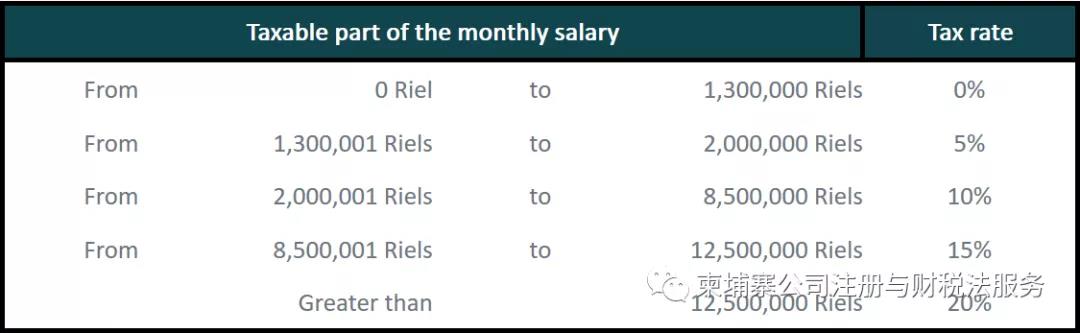

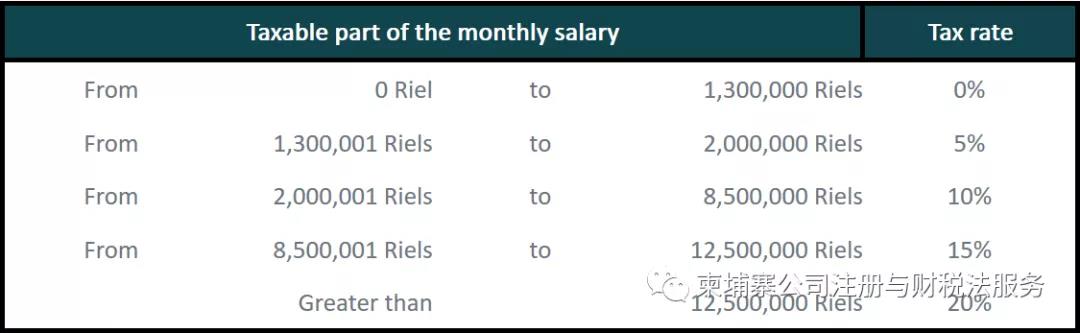

Progressive tax rate of income tax on wages and salaries:

Zhuo Zhi commented: We have noticed that the minimum threshold for salary income tax has been raised from US$300 to about US$325). On the one hand, it reduces the tax burden of employees, but also helps companies to set reasonable labor costs and reduce corporate income tax taxes. This update is beneficial to all companies in Cambodia. You can make good use of this policy.