This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). Customer Service WeChat: exe5555, 0974589151

Cambodia’s investment preferential policies are divided into three parts, namely, qualified investment project preferential policies, special economic zone preferential policies, and special industry preferential policies. This issue introduces the calculation of tax incentives for qualified investment project investment preferential policies, the government’s specific requirements for QIP applications, Which industries should not apply for QIP. The other two parts of preferential policies are introduced in later articles. Professional articles, friends who are short on time can read the last Zhuozhi comments or save them for later use.

1. Encouragement policies for qualified investment projects (QIP)

1. Encouragement policies available for qualified investment projects:

A qualified investment project (QIP) can obtain the following investment incentive policies: choose to exempt corporate income tax or use special depreciation.

(1) Enterprise income tax exemption (optional)

Tax preference period = Trigger Period + 3 Years + Priority Period, (maximum 9 years)

-Trigger Period: From the issuance of the final registration certificate to the last day of the tax year, the trigger period is determined according to the following earlier dates:

a) In the year of establishment, if QIP generates profits, the year of establishment is the trigger period;

b) In the three years after the year of establishment, if in any year, QIP obtains income related to the sale of goods or services from investment activities, the income-generating year and the previous year shall be the trigger period.

-Priority Period: Determined according to the project type and investment capital. For light industry: 0 years if the investment capital is less than US$5 million; 1 year if the investment capital is between US$5 million and US$20 million ; 2 years if the investment capital is more than 20 million US dollars.

(2) Special depreciation (optional)

The value of new or used tangible assets used in production or processing can accelerate the depreciation by a special depreciation policy of 40%.

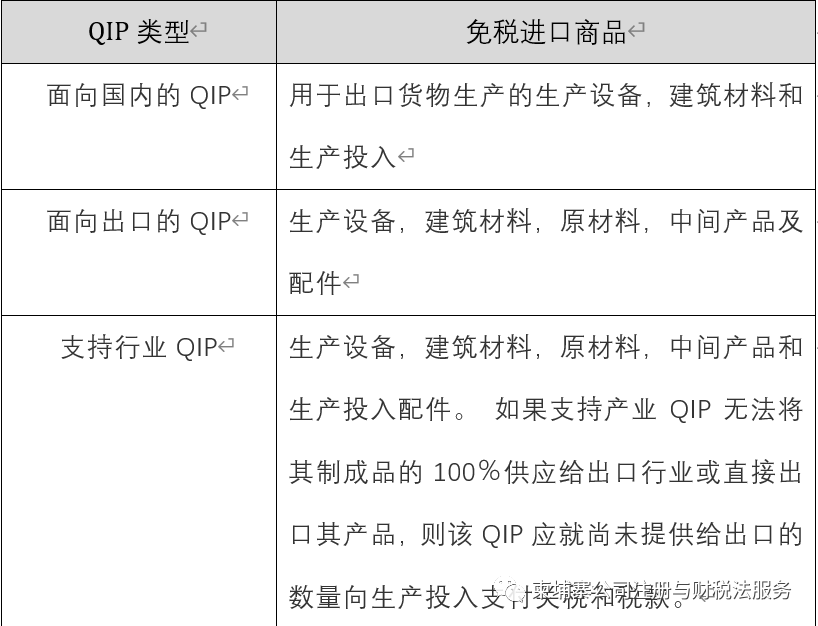

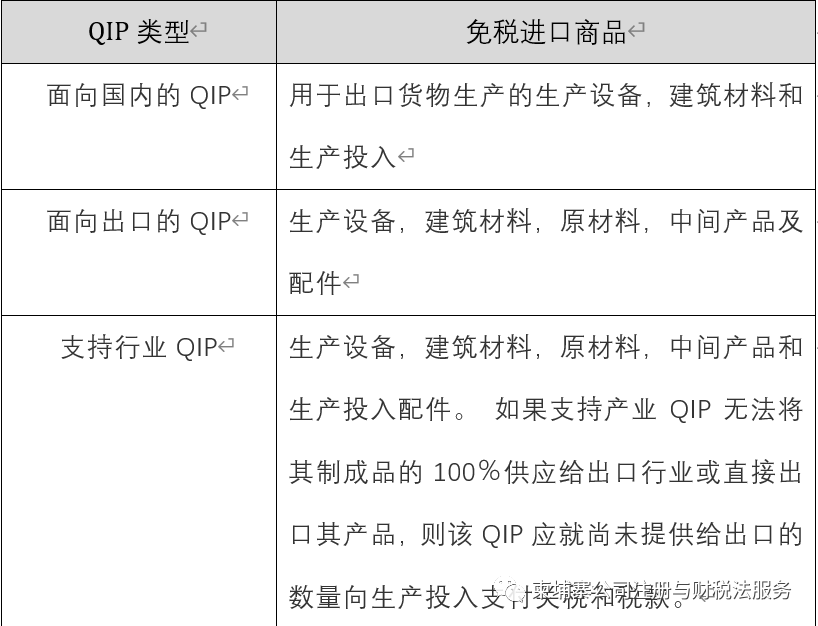

QIP can import production equipment and materials tax-free as shown in the table below:

The QIP located in the designated SPZ or EPZ has the right to receive the same incentive and preferential policies as other QIPs stipulated in the revision of the letter of intent.

In addition to current laws and regulations, QIP should be exempted from 100% export tax.

With the approval of PMIS, the rights of QIP can be transferred to those who have obtained or merged QIP.

2. The Cambodian government's QIP requirements for qualified investment projects:

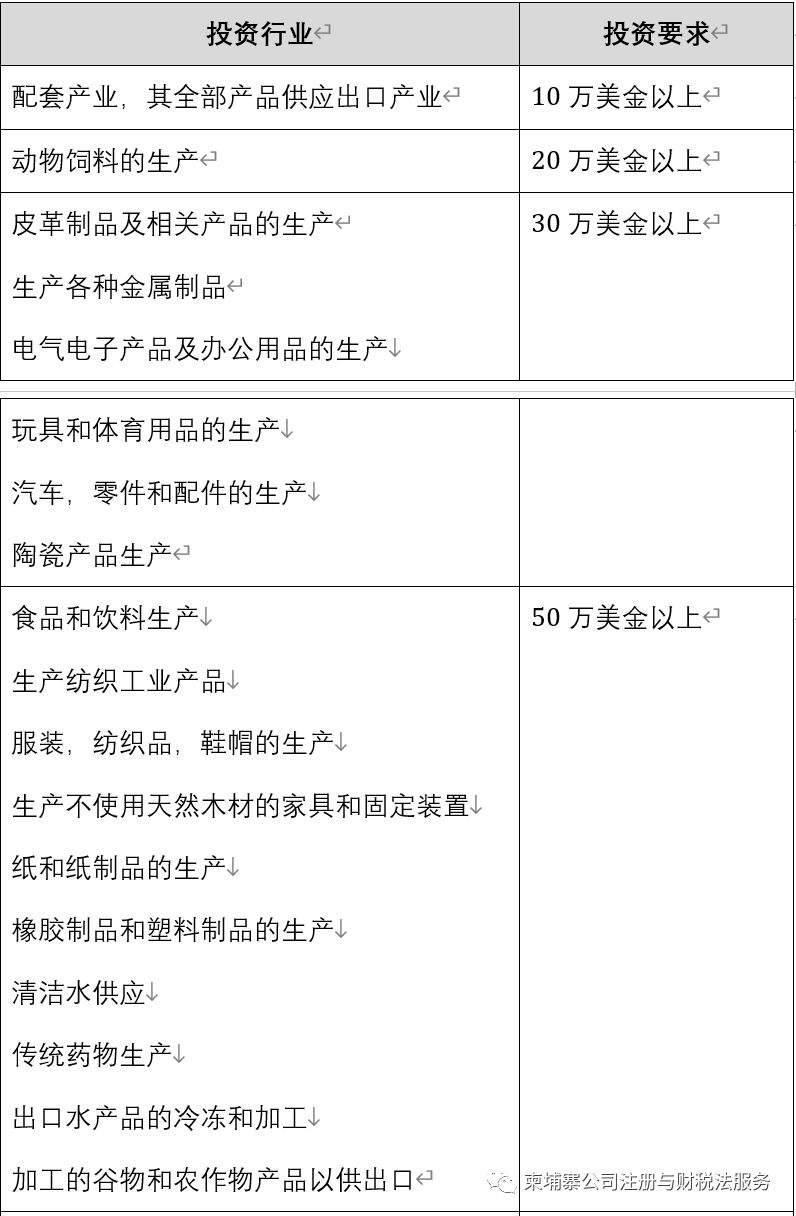

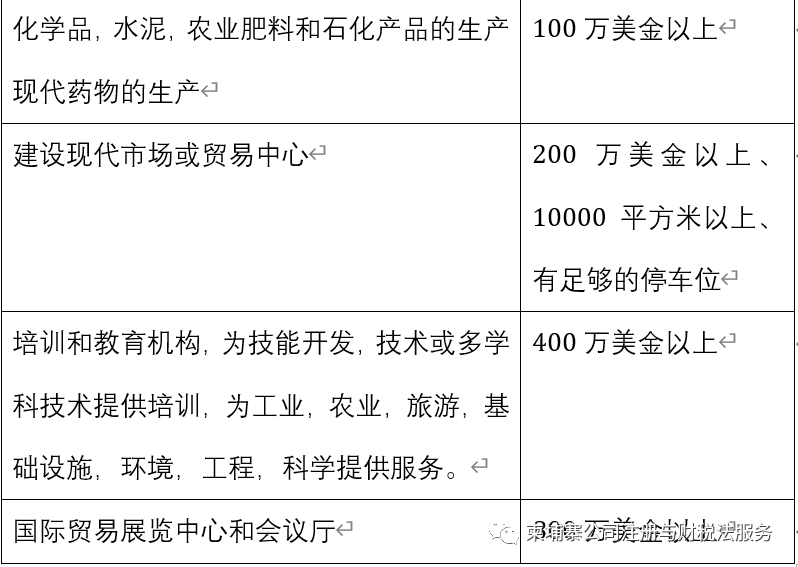

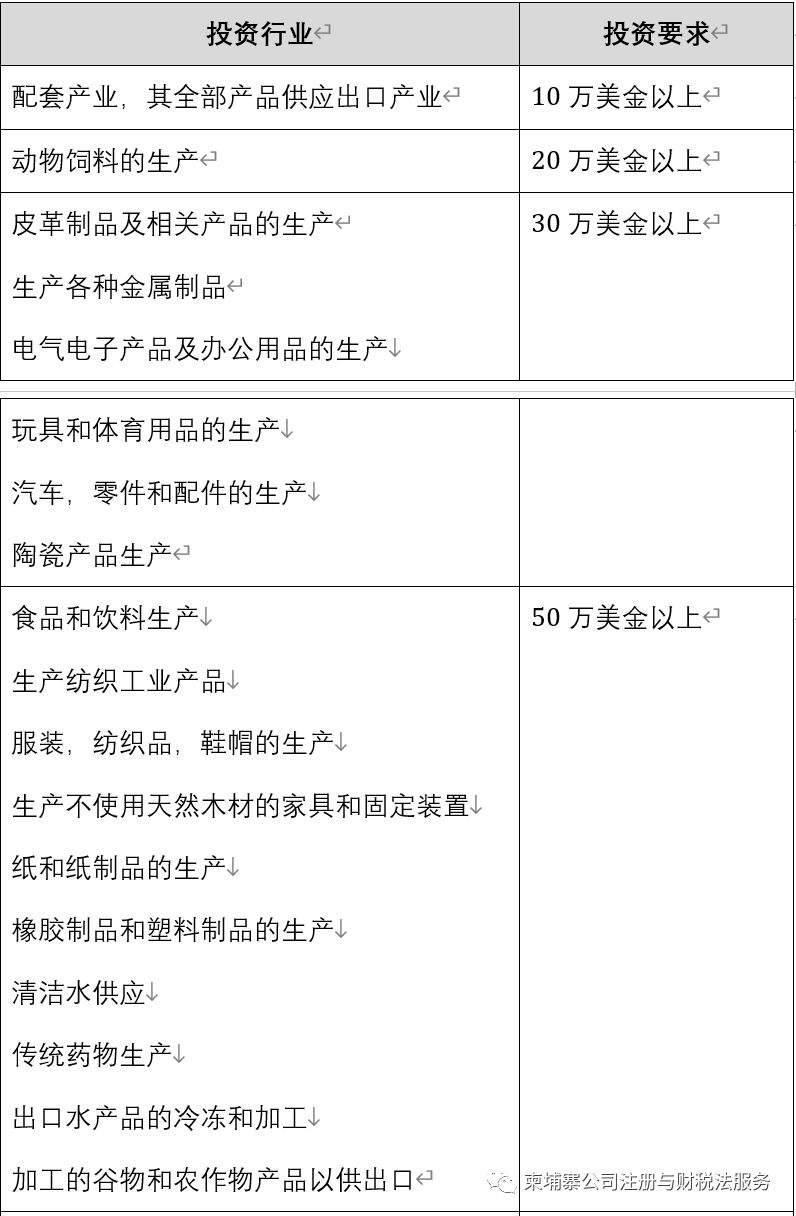

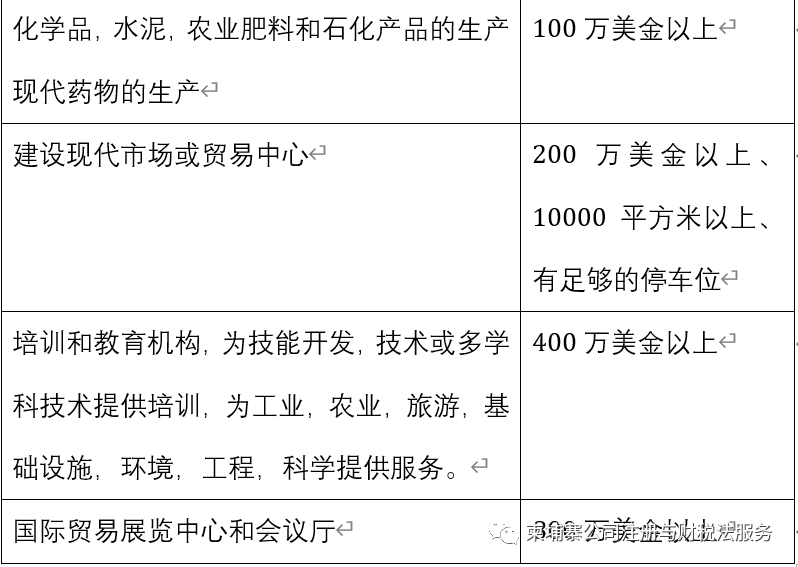

Section 2 of Annex 1 of Decree No. 111 also stipulates the requirements for investment incentives in various industries, including the minimum investment amount or other conditions, as shown in the following table:

3. Industries that do not meet the encouraged conditions (that is, it is not appropriate to apply for QIP):

The following investment projects listed in Section 2 of Annex 1 of Decree No. 111 are not eligible for investment incentives. These investment projects include:

・Various commercial activities, import and export, wholesale and retail, including duty-free shops

・Except for railway investment, any waterway, highway, air transportation service

・Restaurants, karaoke halls, bars, nightclubs, massage parlors, fitness rooms, etc.

・Travel Service

・Casino and gambling industry

・Money, financial business and services, such as banks, financial institutions and insurance companies

・Activities related to newspapers and media, including radio, television, news, magazines, etc.

· Professional service

・Use natural forest trees and legal domestic raw material sources to produce and process wood products

・Comprehensive resorts, including hotels, theme parks, sports facilities, and zoos of less than 50 hectares

・Hotels below three-star

・Real estate development, warehouse facilities

Zhuo Zhi’s comment: QIP is Cambodia’s main preferential investment policy. Investors must first determine whether the investment industry belongs to an encouraged industry and whether it may belong to an encouraged industry, and then determine the specific requirements of QIP for this industry, and plan related work in advance according to the requirements. Determine the Trigger Period and Priority Period for tax incentives, do a good job of tax planning, enjoy incentive policies to the maximum, and reduce tax costs.