This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). Customer Service WeChat: exe5555, 0974589151

Cambodia's investment preferential policies are divided into three parts, namely, qualified investment project preferential policies, special economic zone preferential policies, and special industry preferential policies. In the early stage, we introduced preferential investment policies for qualified investment projects. This issue introduces special economic zone preferential policies and special industry preferential policies, including incentive policies for special economic zone developers, enterprises in the special zone, enterprises in the special zone, and special industries. Professional articles, friends who are short on time can read the last Zhuozhi comments or save them for later use.

2. Encouragement policies for special economic zones

1. Encouragement policies available in Cambodia's special economic zones:

The Special Economic Zone Act stipulates that the Special Economic Zone shall obtain an approval certificate issued by the Cambodia Special Economic Zone Bureau (CSEZB). The CSEZB reviews all SEZ incentive policies, and all incentive policies shall be stipulated in the FRC.

According to Article 14.9 of the 2003 Investment Amendment Law, QIPs located in designated special promotion zones (Special Economic Zone SPZ) or export processing zones (Free Trade Zone EPZ) are entitled to enjoy the same incentives and privileges as other QIPs.

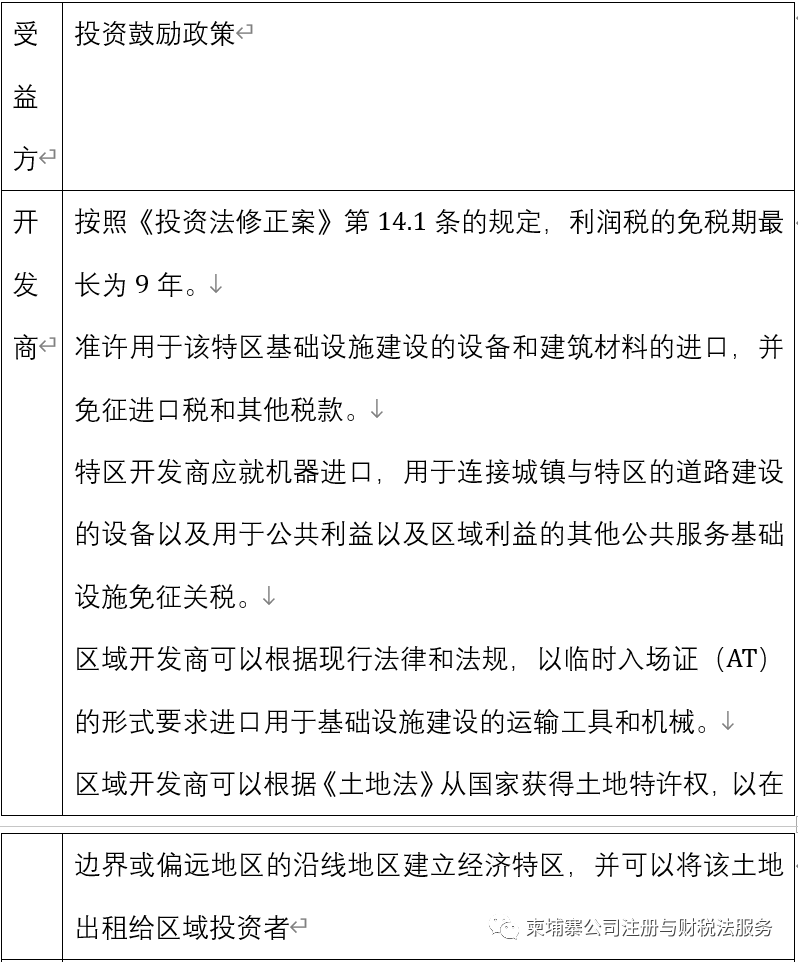

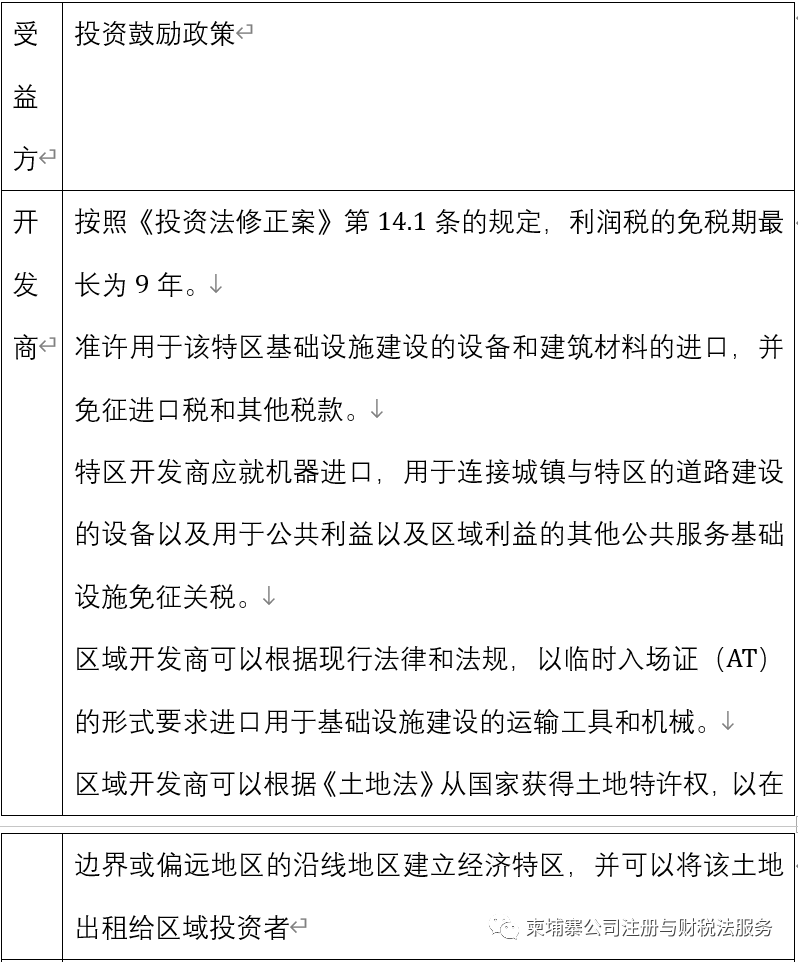

The following table summarizes the incentives granted to SEZ developers and investors in the SEZ:

2. Other incentive measures for special economic zones:

a) Incentive measures for exemption of value-added tax (the Ministry of Economy and Finance issued on March 2, 2010 on the requirements of Letter No. 2128SHV (MOEF), requesting the suspension of the collection of value-added tax on the following matters for investors in the special economic zone)

The incentives for exemption of VAT for investors located in special economic zones have been extended without a specific time limit. The following matters will automatically suspend the collection of value-added tax for enterprises in the special economic zone and do not apply to real estate development projects in the special economic zone.

・Building materials, production equipment, and materials imported in special economic zones by export-oriented QIP.

・Building materials and production equipment imported from the special economic zone for domestic QIP.

・Products produced by QIP in SEZ are made of other QIPs in the same SEZ as raw materials.

b) It has been decided to apply special customs procedures to the SEZs (MEF No. 734 concerning special customs procedures, implemented in the SEZs on September 11, 2008)

1) The special economic zone is located within 20 kilometers from the official border

– Import: At the border checkpoint, only a photocopy is required, instead of submitting the original customs declaration form. There is no need to affix a customs seal. Submit the customs summary declaration form at the entrance of the special economic zone. The customs officer should initially verify the identity of the person involved, the mode of transportation and relevant documents, and then ship the goods to the investor’s location. Importers can use imported goods without the presence of customs officers.

– Export: Customs procedures must be implemented in the special economic zone. If no violations are found, the goods should be immediately released to the border together with copies of relevant export documents. At the border checkpoint, present the customs export documents to the customs officers for verification. If no violations are found, the goods should be released for export.

2) The special economic zone is not within 20 kilometers from the official border,

– Import: National transit procedures apply. The container must be sealed by customs officers.

– Export: Customs procedures must be implemented in the special economic zone, and the container must be sealed before being shipped to the border.

3. Encouragement policies for specific industries

According to Chapter 5 of the revised Investment Law, QIP's investment incentive policies are regulated, but RGC provides for specific industries or other investment incentive policies:

・Import tax reduction and exemption for agricultural machinery such as seeds, tractors and various agricultural materials, and a government-borne value-added tax system (exemption of value-added tax).

・QIPs in the fields of agriculture and agro-industry can be rewarded with a three-year priority tax holiday. According to the "Implementation Regulations of the Investment Law", investment activities in the fields of agriculture and agro-industry should receive such incentives.

・As long as the final product is exported, the value-added tax on the imported production input of the garment factory is exempted.

・Export enterprises of clothing, textiles, and footwear are exempted from VAT on imported supporting production materials and equipment. The production materials and equipment imported by its upstream enterprises are also exempt from value-added tax.

Zhuo Zhi’s comment: Cambodia has many preferential policies for the developers of special economic zones. Those who wish to develop special economic zones should pay attention, especially in terms of land use rights; QIP enterprises in the special economic zones import, domestic purchase, and purchase between enterprises in the special economic zones as raw materials In addition, those who invest in agriculture, textiles and their upstream industries need to fully appreciate the relevant preferential tax policies. Do a good job of tax planning, enjoy encouragement policies to the maximum, and reduce tax costs.