This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). Customer Service WeChat: exe5555, 0974589151

Those who run a business in Cambodia must have heard of tax audits (account checking), whether it is an annual audit or an audit at the time of cancellation. Tax audit is to determine the authenticity, rationality, and legality of the company's tax payment by viewing, calculating, and analyzing account books, tax filing materials, bank records, etc. Then, how does the tax bureau look at the invoice during the audit?

Inter-company transactions

For transactions between the company and the company, special VAT invoices must be issued. For details, see Is there a formal invoice for the Cambodian company? , The special value-added tax invoice can be used as input tax to deduct the value-added tax payable, and it can be used as a cost to deduct the profit. For details, see What tax should be paid for operating companies in Cambodia? How to hand it in? , If you make a tax return and record a transaction with a company, but the other party does not issue a special VAT invoice, both parties need to pay the corresponding tax and be punished by the tax bureau.

Transaction between the company and the individual

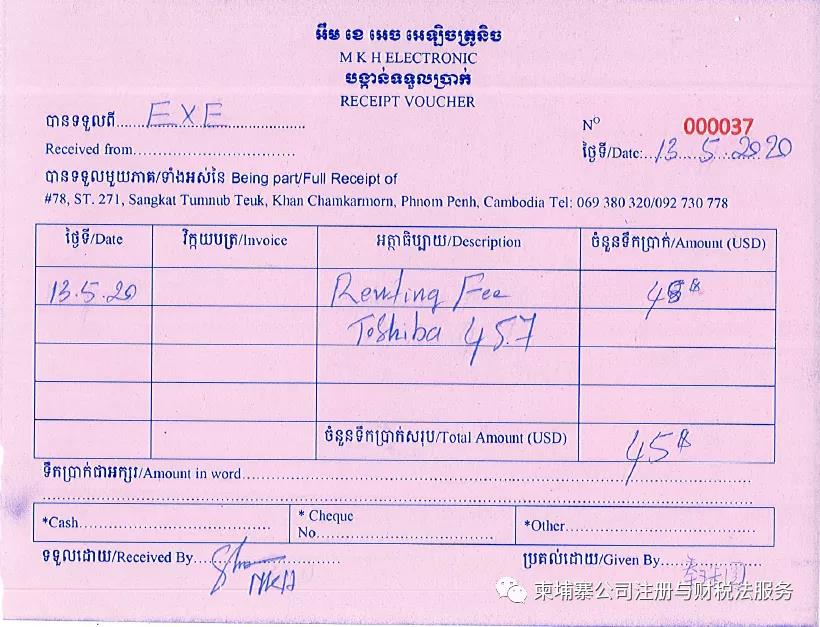

When a company purchases related goods from individuals, the receipts issued by individuals can be recorded in the account according to the facts and cannot be deducted for value-added tax, but can be used as the company's cost and expense to offset the company's profits, affecting corporate income tax. However, for the services provided by individuals to the company, the company needs to withhold and pay corresponding taxes. The samples of receipts issued by individuals are as follows:

Basic tax planning of the company

For transactions that occur between the company and the company when it has income, it must obtain a special value-added tax invoice, which can directly deduct the value-added tax, which is the money. At the same time, it is also used as cost and expense to deduct profits, and 20% less corporate income tax is paid. The real transaction of the company's purchase of goods from individuals can be used as cost and expense to deduct profits. Appropriate and reasonable personnel salary expenditure, this part should pay attention to the impact of welfare tax.

Precautions for company accounting and tax filing

It’s not that the more invoices for the company’s tax declaration, the better, but whether your company actually happened and did it correspond to the corresponding income. For example, if you bought 1 ton of cement and 5 tons of steel bars, you can enter the account, but you bought these What did the stuff do and is there any income? Of course, whether all tax returns and account books are reasonable and whether to pay back taxes is the professional judgment of the auditors. This requires that the usual tax returns are true and reasonable, and that they have sufficient professional knowledge to communicate with tax auditors.