There are countless descendants of dragons who have dreams. They are or will be in Cambodia. They do not pay attention to the relevant laws and regulations of finance and tax. You will be overthrown by sudden attacks, because the speed at which you make money can hardly catch up with a huge legal sanction. (This article is transferred from the Cambodia Investment Guide). This service account insists on originality. The author Zhang Xiaoming, Chairman of Zhuo Zhi Cambodia, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese Certified Public Accountant (CPA), International Certified Public Accountant (ACCA). WeChat: 13928404895, 085502018

President Wang, Fujianese, medium-sized, humble, hardworking, and smart (this kind of person is not successful and difficult), and his skin is slightly dark. He said that he has been in Cambodia for almost a year (you are also black when you come), and he bought a few in Cambodia. A piece of land. Recently, I was looking at a piece of land near the beach in France, ready to buy a house and rent it to BC.

I got acquainted with Wang at a customer’s dinner. They added WeChat to each other. Mr. Wang sent me a WeChat message that evening: “Mr. Zhang, the land is bought under the name of a company established with a Cambodian (I hold 49%). Some are currently idle, some are building houses, and some are being put into use immediately. This does not require accounting and tax filing for the time being, right?"

Because of my answer, he invited me to sit for more than two hours that night.

I think this is a problem that many Chinese investors may have, so I summarize my answer as follows:

一、 As long as the company handles the tax permit, it must carry out accounting and tax reporting. (I encountered a fine of more than 50,000 U.S. dollars for customers who did not file tax correctly)

二、 Mr. Wang may have an evil tax risk. If it is not handled well, it may involve 2.1% of the investment tax!

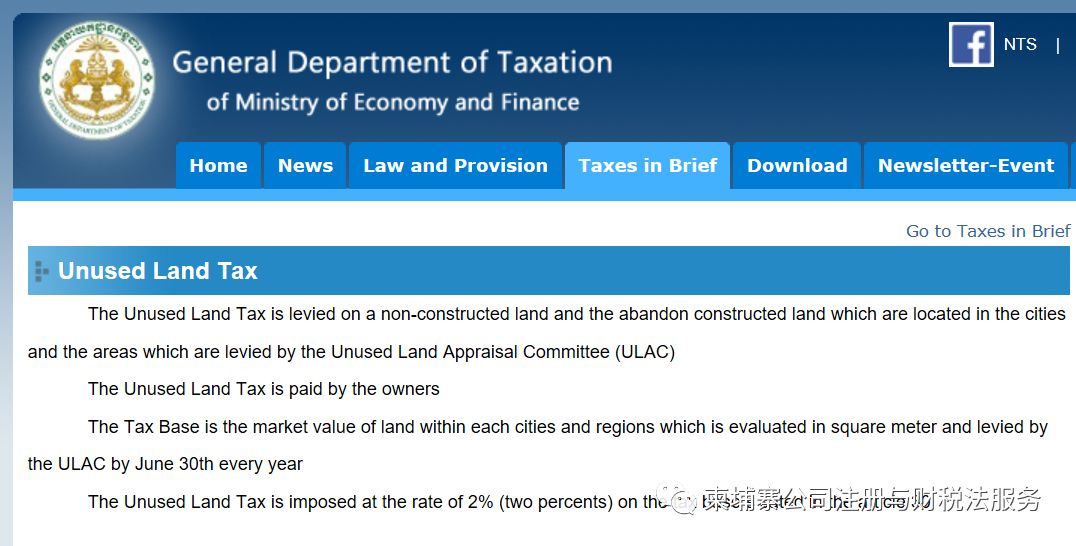

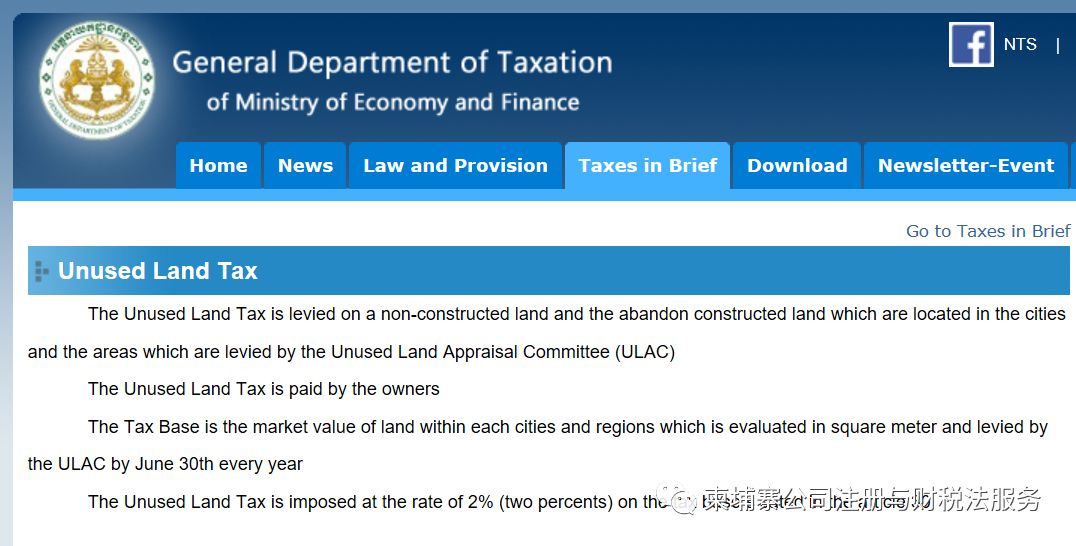

1. Idle land tax: In towns or other special land where there is no construction, a land idle tax is required. The Land Idle Land Evaluation Committee and the municipal cooperation department jointly determine whether a certain relevant province is idle, and determine that the land is idle, which is generally 2% of the estimated value of the idle land.

2. Real estate tax: Land, houses, buildings, and buildings on the land are traded for 1,000,000 riel (25,000 US dollars) real estate tax. Generally 0.1% of the real estate value. The value of real estate is determined by the Property Evaluation Committee of the Ministry of Finance and Economics. Taxes must be paid after September 30 each year.

The agricultural department knows that there are land and related houses under the name of the head company Wang, and the wholesale tax law also has related tax exemption regulations, giving the government a certain amount of space for planning and planning. For specific specific article regulations, please refer to this official account.

三、Mr. Wang may lose 20% of the investment tax.

Anyone who knows a little about accounting and tax law knows that depreciation, that is, the company’s assets, including land and buildings and other large expenditures that can benefit the company for a long time, are depreciated annually, and the tax law also allows deductions (equivalent to expenses) , Just like the company's expense invoice. The corporate income tax in Cambodia is 20%, and Mr. Wang can pay 20% less income tax on the investment. But the prerequisite for the deduction is that the accounts are clear and the value of the relevant assets is well documented.

四、The basis for the confirmation of the original value of the relevant assets.

The bosses have all seen the accounting vouchers and ledgers of Chinese accounting. All the documents are neatly organized and bound and can be stored for many years. Of course, such vouchers are rare in Cambodia at present, but we require accountants to use financial software to bind the accounting vouchers, so that we will arrange and bind all the expenses of Mr. Wang to buy a house and build a house. Shareholders are easy to settle accounts, can save 20% of taxes, and can prove the ownership and original value of the assets.

Certainly, Mr. Wang is now our customer, and he always said that I am very professional (Thank you Mr. Wang). In fact, like everyone else, he may not know what we pay for our usual study. For example, I used a rest day to organize this article. If you find it useful, please forward and like it. This is our biggest motivation for originality. Thank you, Mr. Wang, and thank you all!