This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Cambodia) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). WeChat: 13928404895, 085502018

Recently, we have dealt with several cases of tax repayment by the tax bureau (of course, more consultations), and some of them have received tax payment and fines close to 1 million U.S. dollars in one year. When the customer found us, it was due to the company’s preliminary accounting and taxation. If there is a problem, the relevant information has been submitted to the tax bureau. We can only help to reduce the fine legally and reasonably within a limited range. Just like a patient in the terminal stage of a serious illness, the doctor asked angrily, why didn't you call me long ago?

So why did the Cambodian Taxation Bureau come to check your company's accounts? We have summarized the main reasons for the following four reasons:

1.tax declaration data is abnormal

Let me talk about the EVAT just implemented by the Cambodian Taxation Bureau. E is the Internet, that is, the Cambodian Taxation Bureau also has a similar domestic three-phase golden tax, which automatically compares abnormalities. Such as false value-added tax invoices, abnormal income, or expenditures will be discovered. Here we give a simple example. Your sales VAT invoice is milk, but your special VAT invoice for purchases is steel bars. You turn steel bars into milk for sale. Who do you think the tax bureau does not call you?

The other is the anomaly of internal related data. Everyone knows that Cambodia needs to file tax every month. It is necessary to list the income and expenditure details, including invoice number, invoice content, and amount. In this way, the tax bureau can find problems from such details. For example, a customer is investigated by the tax bureau because the company has spent three consecutive years and has paid more than 200 labor certification fees each year, but has no income. Do you believe this kind of thing? A lot of common sense in life is just because you don't understand finances and taxes. After you do it, it becomes a financial joke. Of course, there are other professional ratios, such as input-output ratio, utility bill ratio, labor ratio, etc.

2. The tax filing data is very different from the actual situation of the company

The current situation that needs attention is that the tax bureau frequently visits companies with actual photos. Through this operation, the tax bureau plays two regulatory roles. One is whether the company has a tax license. If not, the fine will be 2,000 US dollars. About, the second is to understand the actual situation of the company. For example, a customer we received in the past two days, except for the rent of the house, was all 0. As a result, the tax bureau came to see that both buildings were built, one of them There are still people living. The next day I received the tax inspection notice from the tax bureau. We were also informed in the follow-up communication with the tax bureau.

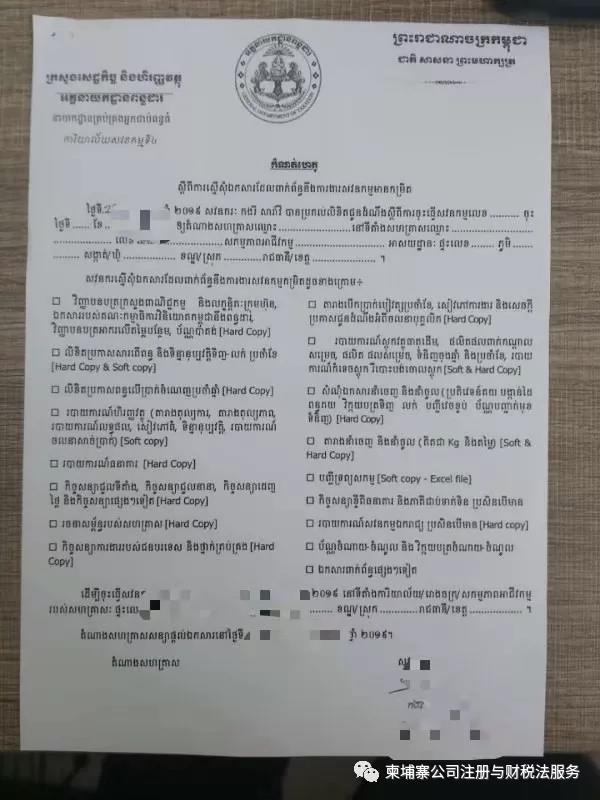

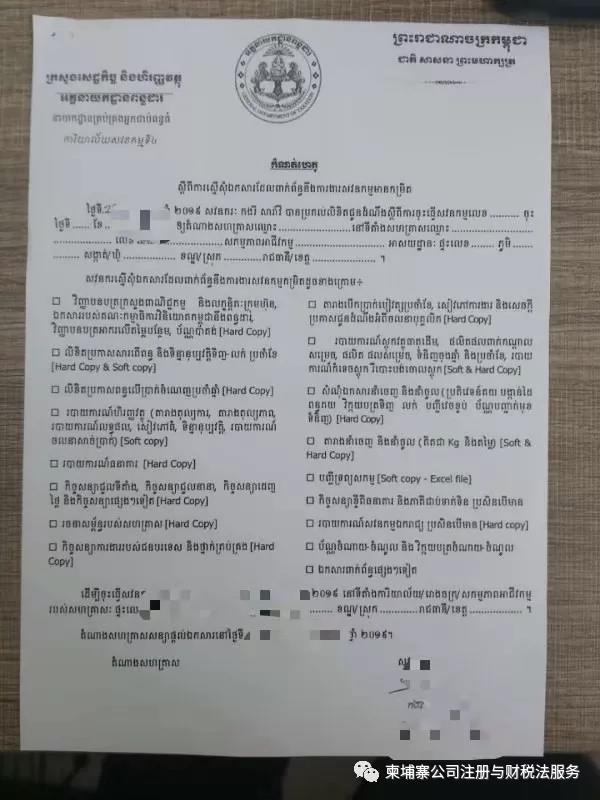

Tax Inspection Notice from Cambodian Taxation Bureau

3.do not file taxes on time

Everyone knows that Cambodia requires to declare to the tax bureau the business situation of the previous month from the 1st to the 20th of each month, regardless of whether there is any business. If a company does not file taxes on time, it is normal for the tax bureau to pay attention and inquiries. Of course, a fine of 500 US dollars for late filing, and late payment fees and interest are calculated separately.

4.routine inspections by the tax bureau

The Jiapuzhai Taxation Bureau conducts audits on enterprises, usually one small review a year and a large review three years. This kind of audit will be arranged according to the personnel arrangement of each tax bureau and the nature of the enterprise, and generally there is no room for discussion. However, professional accountants can also give useful suggestions when the situation permits, such as selecting the tax authority through the registered address and company type.

Of course, in addition to the four reasons, there are also some other reasons, and I have the opportunity to share with you. Of course, everyone may also pay attention to how companies will face tax inspections. We will discuss with you in a later article.