This service account insists on originality. The author is Zhang Xiaoming, partner of Zhuozhi (Vietnam) Accounting Firm, three years of multinational enterprise management experience, six years of listing audit experience, five years of entrepreneurial experience, Chinese certified public accountant (CPA), international certified public accountant (ACCA) ). Customer Service WeChat: hy945568

tax policy

At present, "going out" has become the development direction of more and more companies, but we should do our homework and understand the other party's legal environment before going out. Only in this way can we achieve strategic planning. This article attempts to analyze the current Vietnam tax laws and regulations, and give a detailed description of the main tax types and treatment methods involved in foreign contractors in Vietnam, hoping to deal with Vietnamese taxes for those contractors who have entered the Vietnamese market or are about to enter the Vietnamese market. Provide help in case of problems.

Vietnam tax system

In 1978, under the leadership of Comrade Deng Xiaoping, China put an end to the social line of "closing the country", implemented reform and opening up, opened the country's doors, and allowed foreign companies to enter China, and also allowed excellent domestic companies to go abroad. Due to Vietnam's unusual historical relationship, many Chinese companies first chose Vietnam when implementing the "going out" strategy. Many large companies have set up representative offices in Vietnam or directly established factory workshops. Sun Tzu’s art of war says: “Know yourself and the enemy, so that you can survive a hundred battles.” If a company wants to truly “go out”, it needs to have a detailed understanding of the situation in the target country before going out. One place, one place is destroyed, one place is lost". The ultimate goal of the company's "going out" is to make a profit. Perhaps it was to open up the market at first, but in the end it will return to the pursuit of profitability. With operation, it will involve local taxation, especially for engineering contractors. Taxation is directly related to the life and death of the project. This article intends to analyze the current tax laws and regulations in Vietnam to guide foreign contractors to effectively deal with related tax issues in Vietnam.

Vietnam implements a central-level taxation system. Tax legislative power and tax collection power are concentrated in the central government. The tax bureaus of all provinces and municipalities are directly under the jurisdiction of the State Administration of Taxation. The main taxes in the current tax system in Vietnam are: value-added tax, business income tax (corporate income tax), personal income tax, special consumption tax, deed tax, license tax, customs duty, etc. Unlike China, there is no business tax, and all business units’ invoices are value-added Tax special invoice, the validity period of the invoice is 6 months.

Vietnam’s current tax legal system is still under construction. Therefore, existing laws and new laws and regulations are being revised at any time. This brings greater risks to foreign companies that are not familiar with Vietnamese laws. In addition, Vietnam The country’s foreign exchange reserves are very small and its ability to withstand international foreign exchange risks is low. The currency value of the Vietnamese dong is unstable, making it even worse for foreign contractors. Therefore, it is very important to fully understand the tax laws of Vietnam and make tax planning in advance.

Due to space limitations, this article mainly introduces corporate income tax, capital gains tax, value-added tax, foreign contractor tax, as well as regulations on tax supervision and administrative penalties.

corporate income tax

1. Collection scope and tax rate

According to the current corporate income tax law, the income tax rate is 25%, calculated and paid based on the profit during the tax period. However, for foreign contractors, the main problem is that when calculating profits, revenue is the total contract amount, so the cost of matching it needs to include all foreign invoices such as foreign subcontracting and equipment purchases into Vietnam’s accounts. , And also need to be certified by the Vietnam Taxation Bureau, provide equipment clearance procedures, provide foreign procurement subcontracts, etc. The procedures are complicated, increase administrative public relations costs, and may cause some procedures to fail to meet the conditions of Vietnam’s inclusion of costs, making profits Inflated increase, overpaying corporate income tax.

2. Tax incentives

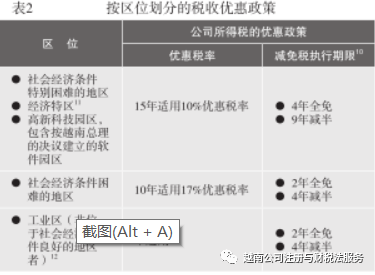

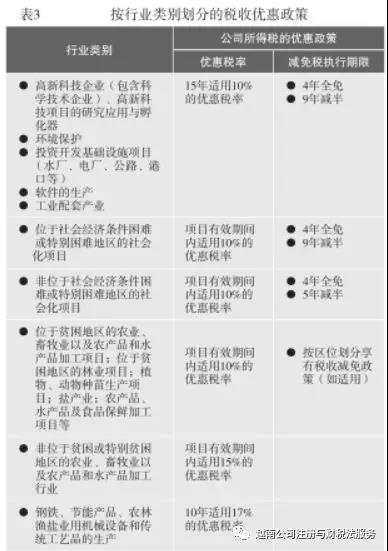

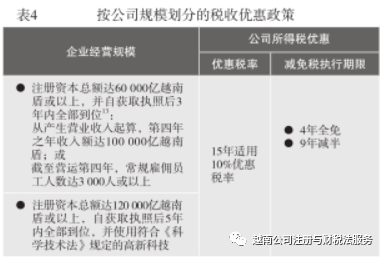

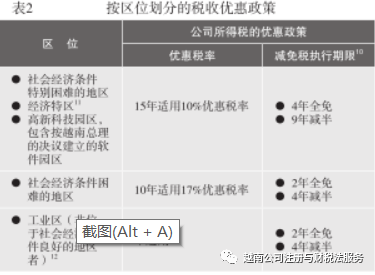

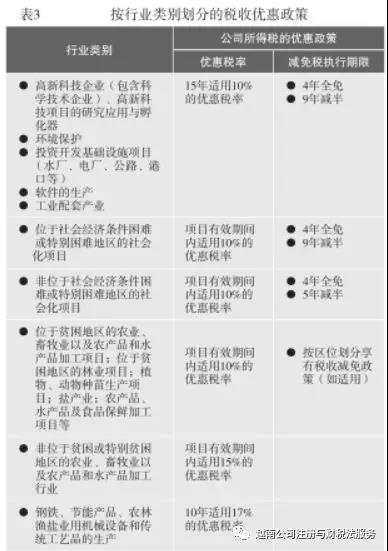

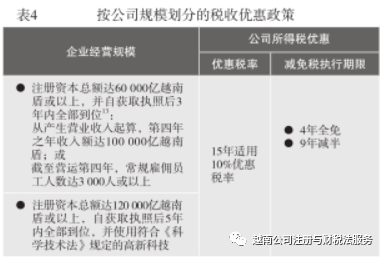

Vietnam has widely adopted preferential tax policies to attract foreign investment. Tax incentives are divided according to three criteria: location, industry category and company size. See Table 2, Table 3, and Table 4 for details.

3. Make up for losses

Within 5 years from the year in which the tax loss occurs, the loss can be carried forward to offset the corporate income. Tax losses cannot be deducted against previous years. Losses from production and business activities that enjoy tax incentives can be deducted from profits from production and business activities that do not have tax incentives. Losses arising from the transfer of real estate, investment projects, and investment project franchise rights (except for mining and exploration projects) can be offset against profits from other operating activities. It is not allowed to make up for losses at the group level.

4. Profit remittance

Foreign investors are allowed to remit profits at the end of each fiscal year or when investment in Vietnam is terminated. If the invested company has accumulated losses, foreign investors may not remit profits. The foreign investor or invested company must notify the tax authorities of the profit remittance plan at least 7 working days before the planned remittance.

VAT

1. Scope of expropriation

The scope of VAT collection covers the goods and services used in production, trade and consumption in Vietnam (including the goods and services purchased from foreign institutions and individuals). According to the current value-added tax law, the value-added tax rate is mainly 10%, 5% and zero tax rate. The tax rate for project contracting is 10%, which is declared based on the current month’s import and export tax. If the output is greater than the input, the difference must be paid to the state treasury before the 20th of the next month. Overdue fees will be calculated at a rate of 0.05% per day. For tax evasion, a fine of 1 to 5 times will be imposed. At the same time, Vietnam implements a consumer value-added tax. All input taxes can be deducted as input as long as the invoices obtained are legal, complete and correct.

2. Applicable tax rate

According to the nature of goods and services, there are three ways to deal with value-added tax: tax-free items, non-declarable value-added tax items, and taxable items.

(1) Tax exemption items: 12 items of goods or labor income are exempted from value-added tax. Specifically include: land use rights; personal insurance; loans and credit services; education and vocational training under current laws; medical services; import of non-locally produced machinery and equipment for specific purposes; temporarily imported goods; duty-free zones and overseas Capital transfer transactions between the two countries; intellectual property rights and software (except for export software); unprocessed or semi-processed agricultural, forestry, animal husbandry and fishery products, livestock seedlings, seedlings, salt, etc.; imported goods and services for humanitarian aid purposes; use of natural Resources and/or minerals are export commodities made by direct processing of raw materials, and their total value plus energy costs account for at least 51% of the main costs.

(2) VAT exemption items: 5 categories of goods or services are exempt from VAT declaration. Specifically include: compensation, financial income; project transfer; inter-company or inter-departmental asset transfer; shareholders to use physical assets as capital; commissions for agency services.

(3) Taxable items: Vietnam is drafting a bill to increase the value-added tax rate. Three tax rates are currently applicable:

● 0: export goods and services; international transportation; direct air or sea transportation by foreign companies or through agents.

● 5%: purified water; teaching aids; books; unprocessed food; medicine and medical equipment; breeding; various agricultural products and services; technical/scientific services; rubber latex; sugar and its by-products; certain cultural, artistic, and sports services / Products and social housing.

● 10%: Standard value-added tax rate, applicable to goods and services other than the above items.

3. Calculation method

(1) Deduction method

The deduction method is applicable to companies that have prepared accounting books, invoices and supporting documents in accordance with current laws and regulations. The tax is calculated based on the difference between the output tax amount and the input tax amount, including:

● Enterprises with annual income of more than VND 1 billion that are taxable items of value-added tax;

● In addition to the aforementioned companies, companies that voluntarily apply for the deduction method. If goods, labor services, and fixed assets are used for the production/sale of taxable and tax-exempt goods or services at the same time, the input tax related to the production/sale of taxable goods or services can be deducted. Taxpayers should calculate the deductible input tax separately from the non-deductible input tax, otherwise the income from tax-exempt goods/services and taxable goods/services will be used to offset the income.

Deduct input tax.

(2) Direct method

In the following cases, the direct method should be used:

● Enterprises whose annual income is less than VND 1 billion, which are taxable items of value-added tax, except those who voluntarily apply for the applicable deduction method

● Enterprises with incomplete and incomplete accounting books, as well as foreigners or foreign-funded enterprises engaged in businesses not specified in the Investment Law

● Individual industrial and commercial households;

● Enterprises engaged in the trading of precious metals and jewelry.

VAT calculation formula according to the direct method: VAT payable amount = VAT taxable income × applicable tax rate. Among them, the applicable tax rate varies from 1% to 5% depending on the type of income.

For companies engaged in the trading of precious metals and jewelry, a value-added tax shall be levied at 10% of the value-added value of the product. The value-added value of precious metals and jewellery is calculated by subtracting the price stated in the value-added tax invoice or payment voucher issued at the time of purchase.

4. Tax refund

Taxpayers who meet the following conditions can apply for a VAT refund to the tax bureau:

● Apply for a new investment project (except in certain circumstances) that is applicable to the deduction method, has not yet started formal operations, and has accumulated input VAT of more than 300 million VND.

● After offsetting the output tax of domestically sold goods, the input value-added tax of exported goods is still higher than 300 million VND (except for goods directly declared for export after import, and goods not exported in the bonded area specified by the customs law) .

● After importing goods and then exporting goods to customers in the bonded area, and the accumulated input value-added tax is more than 300 million VAT, they can apply for a VAT refund.

5. Electronic invoice

Currently, taxpayers can choose to use paper invoices or electronic invoices. However, since November 1, 2020, Vietnam is compulsory to use electronic invoices.

Foreign contractor tax

Foreign contractor tax is not a separate tax, but a special tax policy of income tax and value-added tax applicable to foreign contractors.

1. Taxpayer

Taxpayers of foreign contractor tax include: (1) signing contracts with Vietnamese institutions (as foreign general contractors), or (2) signing contracts with other foreign contractors to provide part of the agreed work (as foreign subcontractors), and Foreign institutions/natural persons who conduct business or obtain income in Vietnam.

2. Expropriation scope

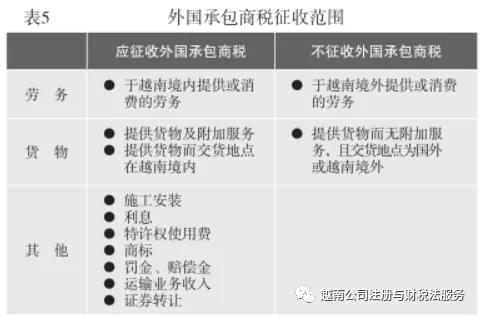

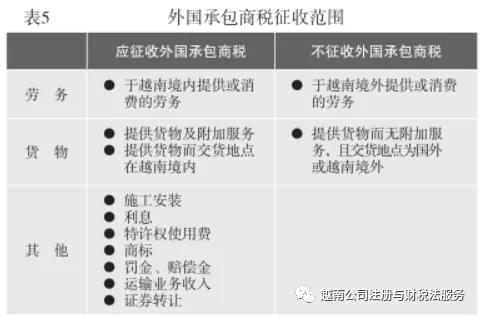

The scope of foreign contractor tax collection is shown in Table 5

3. Tax declaration

The tax declaration methods for foreign contractors include:

(1) Direct method;

(2) Deduction method;

(3) Mixed method;

Among them, the direct method refers to the total project income as the tax base, and the company income tax and value-added tax are levied at a fixed rate; the deduction method refers to the value-added tax levied by the method of output minus input, and corporate income tax is collected by income minus costs. The mixed method refers to the direct method of value-added tax and corporate income tax, and the other method of deduction.

Any foreign contractor can apply the direct method (the most commonly used method), and the deduction method or the mixed method must meet the following conditions before it can be applied:

(1) The contract period is 183 days or more;

(2) Have a permanent establishment in Vietnam (ie "Project Office");

(3) Adopt the Vietnamese accounting system.

4. Applicable tax rate

When the direct method is applied, the fixed tax rate is shown in Table 6.

Transfer Pricing

Vietnam's current transfer pricing method is roughly consistent with the "Organization for Economic Cooperation and Development (OECD) Guiding Principles" and the "Tax Base Erosion and Profit Shifting (BEPS) Action Plan", but there are additional requirements and adjustments.

1. Declaration form and contemporaneous information requirements

Related party transactions must be identified and declared using the prescribed forms within 90 days from the end of the fiscal year and submitted together with the taxpayer’s annual corporate income tax return. Companies are required to conduct a comprehensive self-assessment of their profits and prove that the pricing adopted is based on the principle of independent trading. The enterprise also needs to save the same period data file every year as the basis for determining the independent transaction price method. Decree No. 20/2017/ND-CP stipulates three levels of related transaction documents, including main documents, local documents and country reports. These reports need to be prepared before the filing date of the company's annual income tax return.

2. Advance Pricing (APA) Agreement

The advance pricing agreement has been implemented since 2014. It is divided into three types: unilateral, bilateral or multilateral agreements to determine the transfer pricing method between affiliated companies. The maximum agreement period is 5 years. When the APA agreement expires and the major terms remain unchanged, the taxpayer can apply for renewal.

Tax supervision and administrative penalties

The Vietnamese tax authorities adopt a risk-oriented approach to assess the taxpayer’s level of tax compliance, and then formulate tax supervision and inspection plans. Prior to the tax inspection, the taxpayer will receive a written notice stating the time and scope of the tax inspection. For taxation discrepancies discovered by the tax authorities, the penalty will be calculated at 20% of the undeclared tax, and the late payment fee will be calculated at a daily interest rate of 0.03% (approximately 11% per year). The statute of limitations for payment of taxes and late fees is 10 years, and the statute of limitations for payment of fines is 5 years. If the taxpayer has not registered for tax payment, the time limit for tax collection and late payment fees does not apply.

Other related tax issues

Tax payment

According to the “Business Environment Report” released by the World Bank in 2019, Vietnam ranks 69th among 190 economies. However, in terms of taxation, Vietnam ranks 131st. According to the report, for every 10 tax declaration and payment completed by Vietnamese companies, it takes an average of 498 man-hours per year. Compared with the OECD standard of 159.4 hours and the East Asia and Pacific region's average of 180.9 hours, Vietnamese companies spend more time and energy on tax payment. Tax payment is a cumbersome process for companies doing business in Vietnam.

Tax compliance tax

For enterprises, tax compliance fees include related expenses such as completing tax obligations, tax accountants' salaries, and studying tax policies and regulations.

According to a study conducted by the Central Institute of Economic Management (CIEM) of Vietnam, it takes 1,733 hours for enterprises to go through procedures and purchase value-added tax bills each year, of which 1,680 hours are required to collect data alone. In addition, according to surveys, companies It also takes 728 hours a year to fulfill corporate income tax obligations.

La Xuao Dao pointed out that in terms of tax compliance time and completion of value-added tax obligations, companies in the Jiulong River Delta in Vietnam spend 407 hours a year, while the time spent on corporate income tax payment is 309 hours.

According to the World Bank’s 2012 Business Environment Report, Vietnam’s tax convenience ranks 151st among 183 countries in the world, and ranks last in Southeast Asia. Vietnam is one of the countries with high tax pressure and time-consuming time.

A small and medium-sized enterprise in Vietnam (with revenue of approximately US$1155,000) pays taxes 32 times a year, and takes 941 hours to prepare tax materials, and its average tax expenditure accounts for 40.1% of total profits.

Even after the Vietnamese authorities have improved, the administrative process is still more complicated. Underestimating these processes can lead to backward work plans, wasted money and time, lost opportunities, etc. Therefore, it is recommended to seek help from professional consultants when carrying out tax declaration and other activities.

Not fully adopting the Vietnamese accounting system

Through the above summary analysis, we can see that the main types of taxes for foreign contractors in Vietnam are value-added tax and corporate income tax. The above will be deducted, but the corporate income tax will face the problem of certification of foreign invoices, that is, the problem of determining profits; if the Vietnamese accounting system is not adopted at all, then the local VAT input tax will be lost, and the advantage is that it is exempted In addition to complicated tax filing procedures and easy calculation of corporate income tax, it avoids the troubles of the tax bureau and the tax problems of its Chinese subcontractors; it does not fully adopt the Vietnamese accounting system, which combines the first two methods well. The advantage is that it can be deducted on the input value-added tax, and it can also avoid the complicated income tax filing procedures. Therefore, it is recommended that contractors newly entering the Vietnamese market adopt an incomplete Vietnamese accounting system. Of course, whether to adopt an incomplete Vietnamese accounting system is also determined by the terms of the EPC master contract, whether it is a net price contract, who bears the contract taxes, and comprehensively consider the gains and losses of the two methods to make the most beneficial choice for the project. At the same time, appropriate consideration should be given to other small taxes. Whether the contract requires the import of products subject to import tax and special consumption tax. This should be clearly understood at the project bidding stage. Only in this way can we have the initiative in the project implementation process and gain access to the Vietnamese market. Get a firm foothold and realize "going out" in the true sense.